hawthorne tax rate

There is no applicable city tax. The County sales tax rate is.

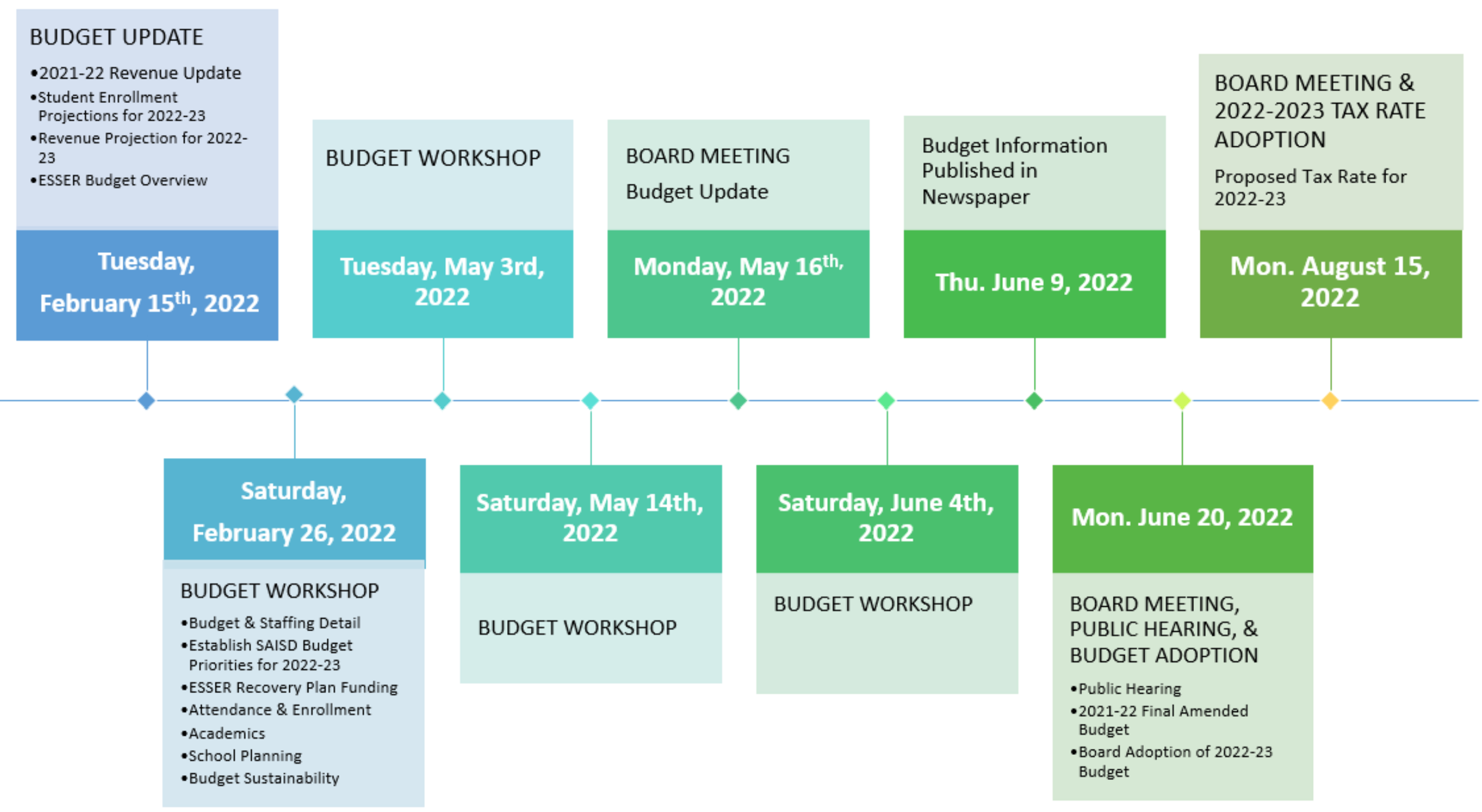

Superintendent Of Schools Saisd

What is the sales tax rate in Hawthorne California.

. LIST OF RELEVANT PROVISIONS. - The Income Tax Rate for Hawthorne is 00. The sales tax jurisdiction name is Los Angeles County District Tax Sp which may refer to a local government division.

Tax bills are due on a quarterly basis and are mailed once a year during the summer. This is the total of state county and city sales tax rates. This includes the rates on the state county city and special levels.

Average Property Tax Rate in Hawthorne. The US average is 46. Water Rent Billing Cycle.

The average cumulative sales tax rate in Hawthorne Wisconsin is 55. What is the sales tax rate in Hawthorne Nevada. The state-mandated tax rate that applied throughout California as of 2017 is 725 percent with revenue allocated to various purposes.

Tax Rate 2017 Per 100 of Assessed Value Receipts Remittances requiring a receipt must be accompanied by the entire tax bill and a self addressed stamped envelope. The December 2020 total local sales tax rate was 7375. The County sales tax rate is.

Hawthorne is located within Westchester County New York. Illinois property tax system PDF Property assessment and billing cycle PDF Annual Budget. The US average is 46.

The sales tax rate does not vary based on zip code. A no vote was a vote against imposing an additional sales tax of 075 percent to fund general city services. Comprehensive Annual Financial Reports.

Businesses impacted by the pandemic please visit our COVID-19 page Versión en Español for information on extensions tax relief and more. Within Hawthorne there is 1 zip code with the most populous zip code being 54842. Tax Rates for Hawthorne - The Sales Tax Rate for Hawthorne is 95.

Hawthorne Property Taxes Range Based on latest data from the US Census Bureau You May Be Charged an Unfair Property Tax Amount Maybe you dont know that a real estate tax bill could be bigger than it should be because of an unfair evaluation. Popular Annual Financial Report. The minimum combined 2022 sales tax rate for Hawthorne California is.

You can print a 8375 sales tax table here. See reviews photos directions phone numbers and more for Sales Tax Rates locations in Hawthorne NJ. Within Hawthorne there is 1 zip code with the most populous zip code being 10532.

Sales Tax Breakdown Hawthorne Details Hawthorne NY is in Westchester County. Official government site of Lake County Illinois. Based on latest data from the US Census Bureau.

Wayfair Inc affect California. This includes the rates on the state county city and special levels. Taxes-Consultants Representatives Tax Return Preparation-Business.

Measure HH proposed to raise the total sales tax rate in Hawthorne from 95 percent to 1025 percent. The minimum combined 2022 sales tax rate for Hawthorne New York is. The US average is 73.

- The Income Tax Rate for Hawthorne is 93. The minimum combined 2022 sales tax rate for Hawthorne Nevada is. Did South Dakota v.

Income and Salaries for Hawthorne. Flat Rate Tax 718 868-0171. The Hawthorne sales tax rate is.

What Is La Tax Rate in Hawthorne CA. The New York sales tax rate is currently. Did South Dakota v.

Sales Tax in Hawthorne CA While the State of California only charges a 6 sales tax theres also a state mandated 125 local rate bringing the minimum sales tax rate in the state up to 725. Art Quotes Praveen Gupta August 16 2022. Hawthorne is in the following zip codes.

Learn all about Hawthorne real estate tax. - Tax Rates can have a big impact when Comparing Cost of Living. Hawthorne Property Taxes Range.

The current total local sales tax rate in Hawthorne NY is 8375. Bills for Added Assessments. This is the total of state county and city sales tax rates.

The sales tax rate does not vary based on zip code. - The average income of a Hawthorne resident is 25020 a year. This is the total of state county and city sales tax rates.

The Hawthorne sales tax rate is. Income and Salaries for Hawthorne - The average income of a Hawthorne resident is 20445 a year. Hawthorne is located within Douglas County Wisconsin.

Name A - Z Hutchinson Bloodgood LLP. Did South Dakota v. The Borough now accepts payments by credit card both online and in the Tax Office and by direct bank debit online only.

The US average is 28555 a year. -075 lower than the maximum sales tax in CA The 1025 sales tax rate in Hawthorne consists of 6 California state sales tax 025 Los Angeles County sales tax 075 Hawthorne tax and 325 Special tax. The US average is 73.

The average cumulative sales tax rate in Hawthorne New York is 838. What is the sales tax rate in Hawthorne New York. The Nevada sales tax rate is currently.

Online videos and Live Webinars are available in lieu of in-person classes. What are you looking for. Phone 973-427-5555 Free Hawthorne Treasurer Tax Collector Office Property Records Search Find Hawthorne residential property records including owner names property tax assessments payments rates bills sales transfer history deeds mortgages parcel land zoning structural descriptions valuations more.

Wayfair Inc affect New York. Otherwise it is acceptable to detach the appropriate stub to mail along with your check and the canceled check will serve as your receipt. Quarterly and due 30 days from date of bill.

The sales tax jurisdiction name is Mount Pleasant which may refer to a local government division. - Tax Rates can have a big impact when Comparing Cost of Living. Exposure Draft ICAI Code of Ethics 2018 08-10-2018 Powers of the Standing Committee.

Wayfair Inc affect Nevada. Whether you are already a resident or just considering moving to Hawthorne to live or invest in real estate estimate local property tax rates and learn how real estate tax works. The Hawthorne sales tax rate is.

For questions about filing extensions tax relief and more call. Please specify your payment is for water. YEARS WITH 800 836-6007.

The County sales tax rate is. The California sales tax rate is currently. The 8375 sales tax rate in Hawthorne consists of 4 New York state sales tax 4 Westchester County sales tax and 0375 Special tax.

- The Median household income of a Hawthorne resident.

California Sales Tax Rates By City County 2022

Economy In Hawthorne California

Hawthorne Gardening Q1 Sales Fall 38 To 191 Million New Cannabis Ventures

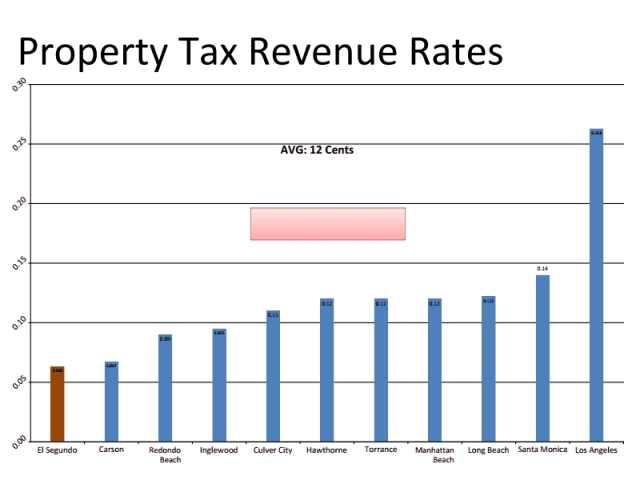

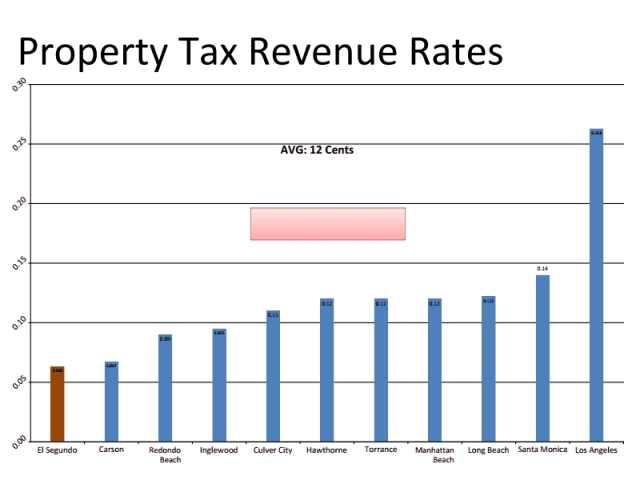

El Segundo To Fight For Fair Share Of Property Taxes Easy Reader News

Florida Sales Tax Rates By City County 2022

14 3 Tax Hike Coming To Parsippany Tuesday Parsippany Nj News Tapinto

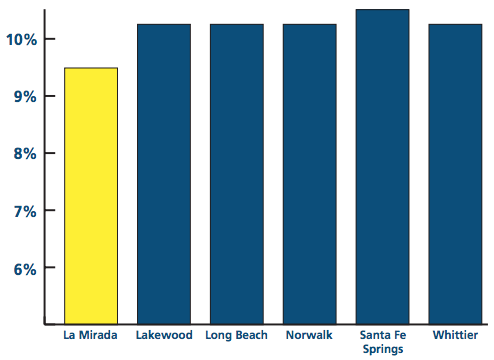

Local Sales Tax Rate Is Lowest In County La Mirada Chamber Of Commerce

Los Angeles County S Sales Tax Rate To Increase Measure M Will Take Effect July 1 The Citizen S Voice

Hawthorne California Ca 90303 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

County Surcharge On General Excise And Use Tax Department Of Taxation

14 3 Tax Hike Coming To Parsippany Tuesday Parsippany Nj News Tapinto

0 Response to "hawthorne tax rate"

Post a Comment